6 Easy Facts About Short-term Loan Canada Described

Wiki Article

Get This Report on Short-term Loan Canada

Table of ContentsOur Short-term Loan Canada IdeasShort-term Loan Canada Fundamentals ExplainedThe Ultimate Guide To Short-term Loan CanadaSee This Report on Short-term Loan CanadaThe Buzz on Short-term Loan CanadaExamine This Report about Short-term Loan Canada

The estimations and also amortization routine produced are: (i) based on the accuracy and efficiency of the information you have gone into, (ii) based upon presumptions that are believed to be affordable, and also (iii) for estimate purposes just as well as need to not be depended upon for specific monetary or various other recommendations. When you make your credit application, passion prices may have changed or may be various due to information contained in your application.

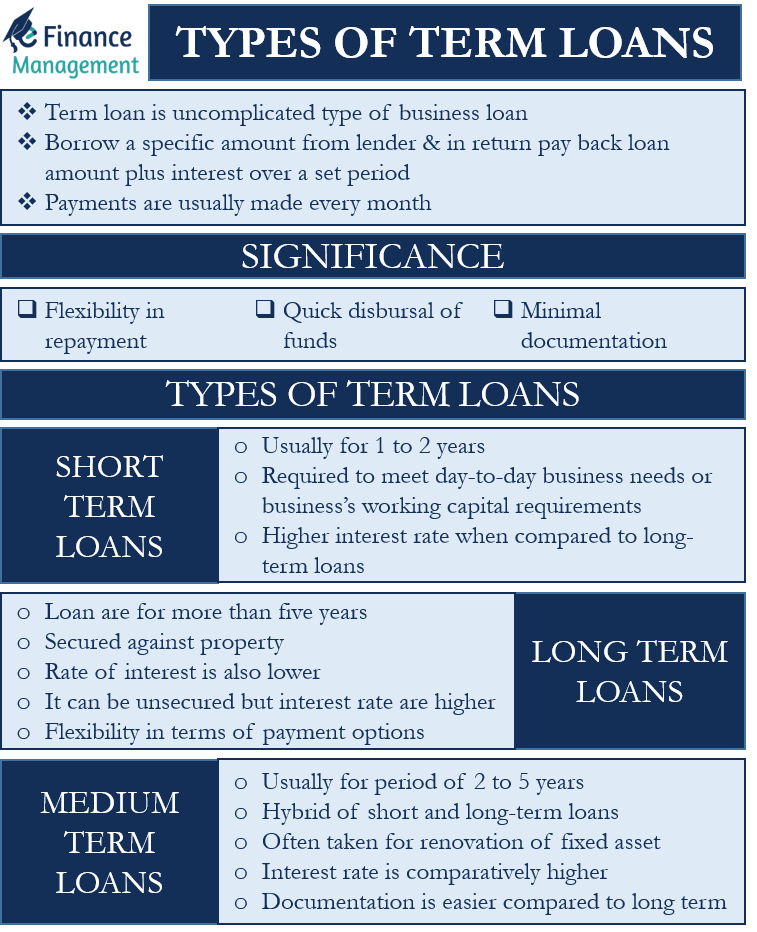

They are unprotected lendings, implying that you do not require to secure your car loan versus your residence or cars and truck or any kind of various other home. If you take out a short-term car loan you are called for to pay back the exact same quantity each month to the loan provider up until the funding and also the rate of interest are paid off.

How Short-term Loan Canada can Save You Time, Stress, and Money.

9% You after that are called for to pay back 178. 23 to the lender monthly for the following three months. After the 3 months you will have paid back a total amount of 534. 69. It would have cost you 34. 69 to borrow that 500. At Money, Girl, we make discovering a short-term lending fast and also easy.We after that offer your application to the 30+ loan providers on our panel to discover the lending institution probably to accept your application, at the very best APR readily available to you. We will after that route you straight to that lenders internet site to complete your application. Our service is complimentary and many thanks to our soft search modern technology has no effect on your credit report.

By comparison, a short-term finance is spread over 2 or more months. For numerous people, spreading the cost over numerous months makes the lending payments much more budget friendly.

Short-term Loan Canada Fundamentals Explained

All About Short-term Loan Canada

If you are contrasting finances online, you might find that the rates of interest on short term finance products look high when contrasted to headline funding rates promoted by high street financial institutions or constructing societies. One essential reason for this is that short-term lenders cater to lending to those with bad debt accounts or no credit rating in all.This threat is handed down to the clients in the type of a higher rate of interest. If you fall short to fulfill your settlements then of course, your credit report could be negatively affected. This is real of any type of loan or credit item, not simply temporary lendings. Alternatively, if you satisfy all your repayments completely and on time after that this can suggest that you can be depended take care of credit well and also might boost your credit rating.

If you satisfy all these requirements, after that indeed you are eligible to use. If you are battling with your financial resources and also anxious about your financial debts then there are a number of organisations that you can count on free of charge and unbiased recommendations. See the links listed below.

Getting The Short-term Loan Canada To Work

Cash advance are temporary financings of approximately $1,500 supplied in exchange for a post-dated paycheque or other pre-authorized debit that the lender makes use of for future payment of the finance, plus any type of interest and costs. If the cash advance is not repaid on time, it can cause even more interest and also fees. short-term loan canada.have a peek at this site If you obtain $500 for a cash advance finance, you can be charged up to $75 in passion as well as fees. This may not feel like a great deal of cash, however the short duration of a payday advance means they have much higher passion costs than other types of loans.

Allow's compute what a cash advance might cost you. Say that: The amount of your following paycheque will certainly be $1,000 You would love to secure a payday advance for $300 The cost to borrow the car loan is $45 The overall price to pay back the finance is $345. That means the amount you will certainly receive from your next paycheque will certainly be $655.

Facts About Short-term Loan Canada Revealed

Payday lending institutions are controlled in B.C., suggesting any kind of firm that uses payday advance loan should be licensed and adhere to regulations established by the provincial government. You can inspect to see if a company is licensed with this. The organization should additionally present the permit anywhere it provides payday advance, whether online or in-person.If you have concerns or worry about a payday advance loan or loan provider, contact Consumer Defense BC.

If high rising cost of living is squeezing your budget, you aren't alone. A current survey by Finder found that 36 percent of Canadian customers said their major factor for taking out a lending is to cover costs for rental visit our website fee, home loan, food and transportation. With rising cost of living at 7. 6 percent, many Canadians are relying on financings to spend for needs.

Report this wiki page